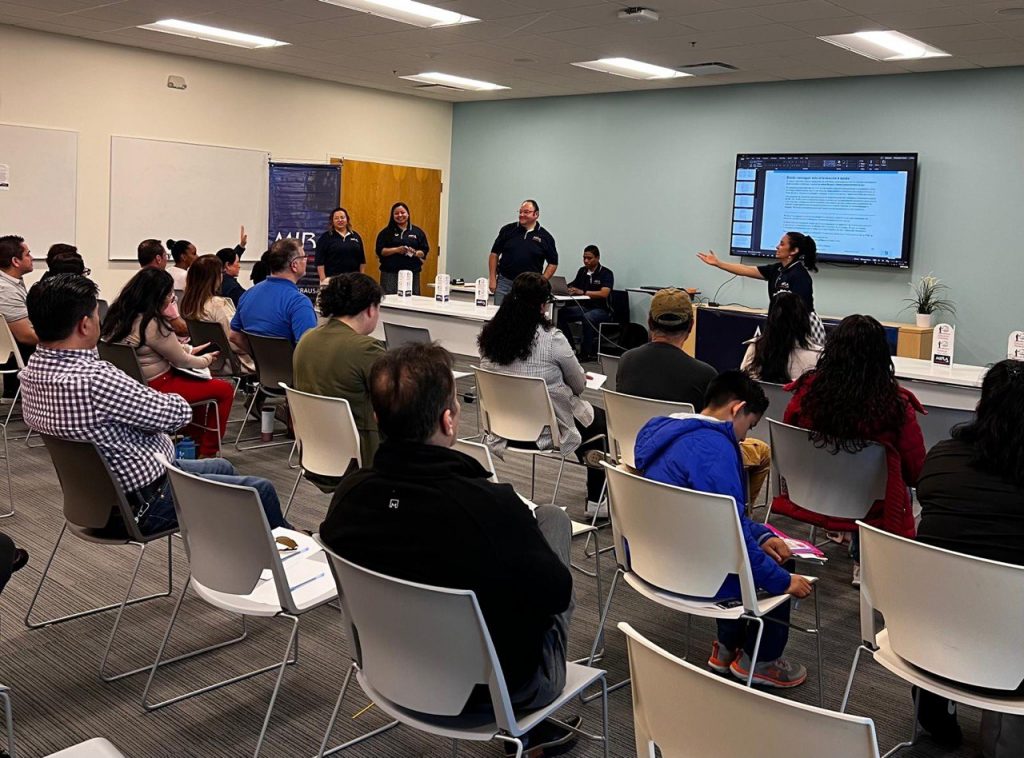

In Charlotte, NC, three dedicated volunteers from MIRA USA-Charlotte conducted an in-person workshop titled “Credit Scores and How to Use Them to Your Advantage” on Saturday, April 13, at the South Boulevard Public Library. The volunteers were trained through the “Money Smart” financial program by the Federal Deposit Insurance Corporation (FDIC), enabling them to share comprehensive information about credit scores with the immigrant community.

“The information we received was excellent. This workshop provided us with the knowledge to put into practice and improve our credit,” expressed Jasmín España, one of the attendees.

The workshop, divided into three segments, covered essential topics such as the importance of requesting and reviewing credit reports, understanding what constitutes a good credit score, and taking steps to improve credit scores. Additionally, a representative from Fifth Third Bank was present to provide further insights and answer attendees’ questions.

The workshop concluded with practical examples and targeted information, as the panelists addressed various questions from the audience, ranging from how to establish credit history for young people to how different credit entities calculate scores. This successful workshop provided valuable, practical information to several members of our community, helping them improve their financial situations.

Related Post

MIRA USA Volunteers Join High-Impact Day at Houston Food Bank | Houston, TX

On June 6, 2025, volunteers from MIRA USA Houston,

“Activate Your Alarm, Save a Life” Installation Day | Paterson, NJ

On Saturday, May 31, 2025, MIRA USA proudly participated